NASHVILLE — Two months after downgrading the U.S. hotel forecast at the NYU International Hospitality Investment Forum, CoStar and Tourism Economics further downgraded growth projections in a revised 2025-26 U.S. hotel forecast released this week at the 17th Annual Hotel Data Conference in Nashville.

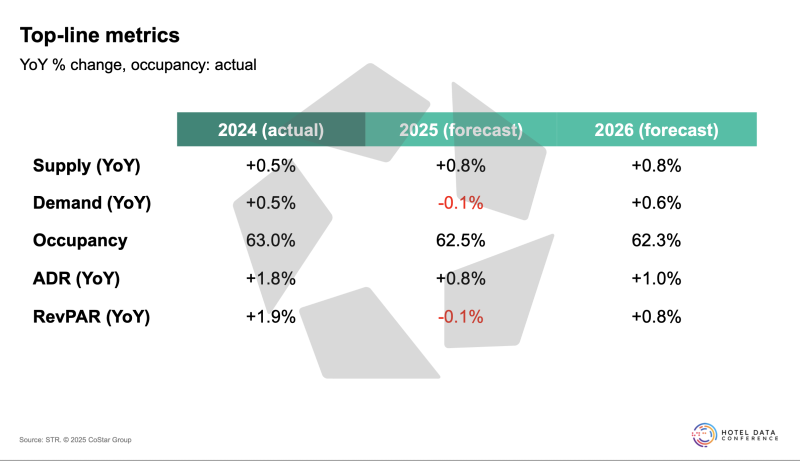

The industry started the year with a projection of +1.8 percent in January. In June, CoStar and Tourism Economics revised the forecast to +1 percent for the year.

Given continued underperformance and elevated macroeconomic concerns, forecasted growth rates were lowered across the top-line metrics: demand (-0.6 percentage points), average daily rate (-0.5 percentage points) and revenue per available room (-1.1 percentage points).

Similar adjustments were made for 2026: demand (-0.5 percentage points), ADR (-0.3 percentage points) and RevPAR (-0.7 percentage points).

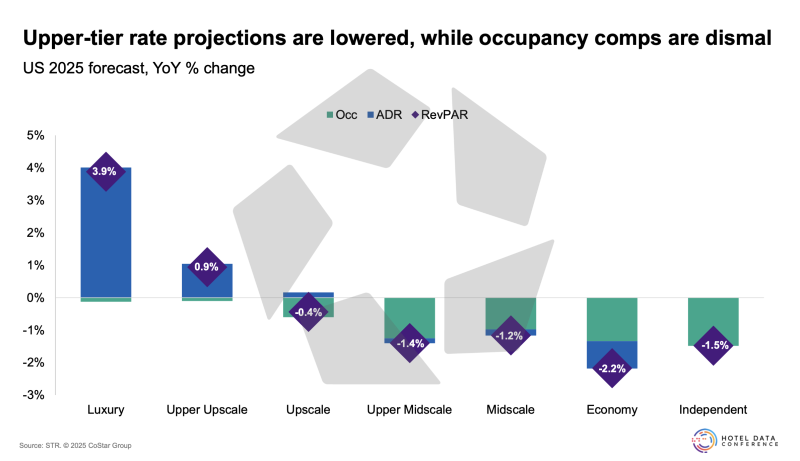

"It's gonna be some of the worst performance we've had in several years now," STR President Amanda Hite told Hotel Management during the conference. "In the U.S., luxury and upper-upscale are going to be the segments that are growing. They will have growth this year on a positive note but for every other segment, it could be a street corner fight for shifting of demand share."

Looking Ahead

Hite was sorry to warn attendees that the second half of this year is going to be tough. "We've already seen the best of year," she said. "The next six months are really going to be rocky and probably not feel so great, because we saw the bulk of our growth in the first half of the year, unless you're a luxury hotel, and we will still see positive RevPAR growth from the luxury segment.

“Unrelenting uncertainty and inflation, coupled with tough calendar comps and changing travel patterns, have caused lower demand,” Hite said. “Additionally, as the year has unfolded, we’ve seen rate growth converge closer with demand. We expect little change in the economic outlook over the next 18 months, but we are optimistic that once trade talks have concluded and the impact of the budget reconciliation bill comes to fruition, hotel performance will recover.”

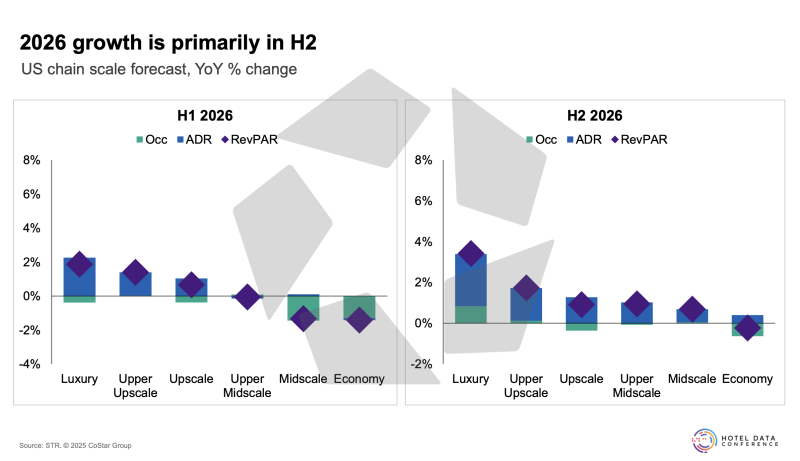

"The slowing U.S. economy should absorb the effects of tariffs without tipping into a recession,” said Aran Ryan, director of industry studies at Tourism Economics. “The current environment—characterized by slowing consumer spending, reduced business capital spending and declining international visitation—will transition to one boosted moderately by tax cuts and less policy uncertainty as we look to 2026.”

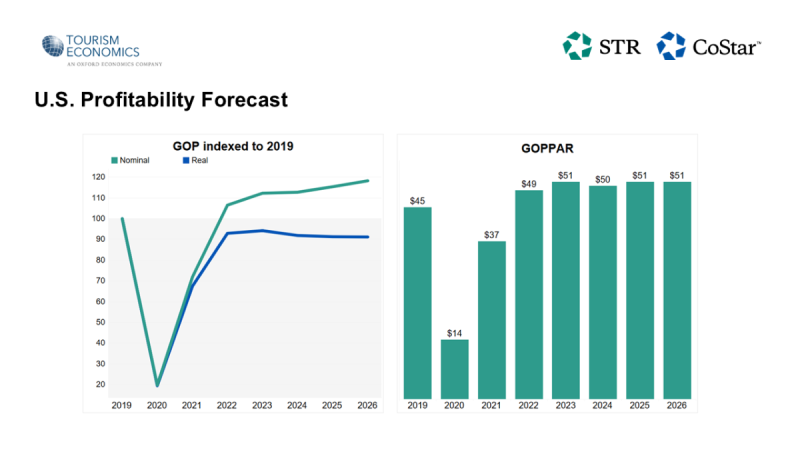

“While our [gross operating profit per available room] forecast remains unchanged from the previous revision, GOP margins were revised down 0.3 percentage points for 2025 and 2.3 percentage points for 2026, mainly due to a potential increase in expenses, particularly F&B,” Hite said.

Looking forward to 2026, there could be some bright spots in the second half of the year and with some major sporting events coming to the U.S. "We originally had expected international demand to start picking up in 2026, with the big driver being World Cup."

But that could be a big question mark. Hite cautioned that while STR does not expect to see "a big uptick in occupancy" from the sporting event, the growth in demand could drive rates. "We would expect there to be some elevated ADRs in those markets around World Cup, which certainly will help growth next year."

The lack of international inbound traffic is certainly affecting the U.S. market as well, but perhaps the weaker dollar could draw some of those international travelers back to the U.S., Hite said. But the dollar isn't weakening against every currency so it could depend, she added—especially with travelers from a visa-waiver country.