According to JLL’s H1 2025 Global Hotel Investment Trends Research Report, transaction volume softened during the first half of the year amid “heightened uncertainty” as investors struggle to underwrite portfolios and large deals.

The report highlighted some notable shifts for the first two quarters of the year. Notably, at $24.5 billion, total transaction volume was down 17.5 percent compared to 2024 and down 31 percent compared to 2019. (The report counted 600 total transactions for the two quarters, down 16.7 percent from 2024 and down 7.8 percent from 2019.)

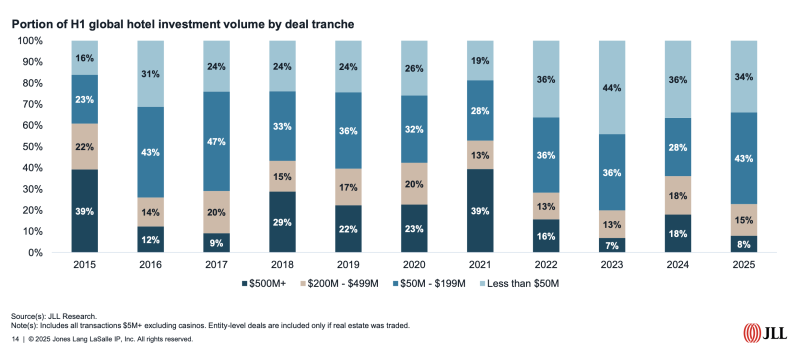

While the volume was down, price per key grew “modestly,” driven by increased demand for luxury assets. Still, the report noted that select-service deals “fuel the bulk of liquidity underpinned by smaller [check] sizes,” and that deals surpassing $200 million were “notably absent,” making up less than a quarter of transactions. In comparison, deals valued at $500 million or more made up 39 percent of the total stack in both 2015 and 2021.

The report did note some positive news: The single-asset price per key grew 2.5 percent year over year to $241,000, although this was still down 3.4 percent from 2019, indicating some lingering effects from the worst of the COVID downturn. And 20 transactions were calculated at more than $1 million per key, the second most in a first half since JLL began tracking hotel deals.

Looking ahead, JLL’s analysts expect significant cash reserves and liquid securities on the sidelines—coupled with increased debt maturities—to fuel additional activity in H2.