During the company’s second-quarter earnings call with investors, Choice Hotels International President and CEO Patrick Pacious highlighted the company’s international gains over the previous three months.

Choice’s international rooms portfolio increased 5 percent year over year, highlighted by a 15 percent increase in hotel openings. “With an 11 percent increase in our rooms pipeline since the start of the year, we are very optimistic about the continued accelerated growth of our more than 140,000 rooms outside of the U.S., and see a significant opportunity to further gain international market share in the coming years,” Pacious said.

Notably, the company acquired the remaining 50 percent stake in Choice Hotels Canada from long-time joint venture partner InnVest Hotels for approximately $112 million.

“Canada presents an attractive opportunity, with the lodging market projected to grow at an average annual rate of more than 5 percent over the next five years, reaching over $50 billion in total revenues by 2030,” Pacious said.

The company already has 327 units and more than 26,000 rooms in the market, he continued, along with a pipeline of more than 2,500 rooms, approximately 9 million customers and more than 200 Canadian franchisees. Management expects the total Choice Hotels Canada business to generate approximately $18 million in earnings before interest, taxes, depreciation and amortization for full-year 2025.

Among Choice’s other international efforts during the quarter, the company:

- Extended a master franchise agreement for over 10,000 rooms in Brazil with Atlantica Hospitality International by 20 years,

- Nearly triplied the room count in France through a direct franchise agreement with Zenitude Hotel-Residences, and

- Signed strategic agreements with SSAW Hotels & Resorts in China, including a distribution agreement that is expected to add more than 9,500 rooms in 2025 and a master franchising agreement, which is expected to add approximately 10,000 rooms over the next five years.

In terms of financials, international EBITDA grew 10 percent during the quarter.

FInancial Performance

The second quarter proved to be a mixed bag for Choice. Net income was $81.7 million for second quarter 2025 compared to $87.1 million in the same period of 2024. Similarly, domestic revenue per available room decreased 2.9 percent year over year for the quarter. (Excluding the Easter and eclipse impacts, domestic RevPAR declined approximately 1.6 percent for second quarter 2025, compared to the same period of 2024.) CFO Scott Oaksmith credited the decline to “reduced government and international travel as well as softer leisure-transient demand due to the broader economic uncertainty” during the call with investors.

However, adjusted EBITDA for Q2 grew to $165 million, a second-quarter record and a 2 percent increase compared to the same period of 2024. Excluding the impact of a $2 million operating guarantee payment for a portfolio of managed hotels, which was acquired in connection with the company's purchase of Radisson Hotels Americas, second quarter 2025 adjusted EBITDA was $167 million.

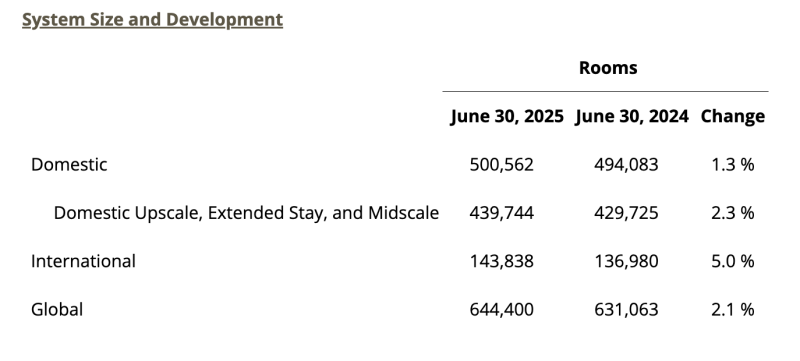

System Size

During the quarter, Choice increased its net global rooms system size 2.1 percent, including 3 percent growth for global upscale, extended-stay, and midscale rooms portfolio, year over year. The international rooms system size grew 5 percent, highlighted by a 15 percent increase in openings, compared to June 30, 2024.

The company’s global pipeline exceeded 93,000 rooms as of June 30, 2025, including nearly 77,000 domestic rooms. Its domestic extended-stay segment increased 10.5 percent compared to year over year, and the segment's pipeline reached nearly 43,000 rooms as of June 30. “Over the past five years, we have expanded our extended-stay portfolio by over 20 percent to nearly 54,000 rooms, with the segments pipeline now constituting half of the total domestic rooms pipeline,” Pacious said during the call.

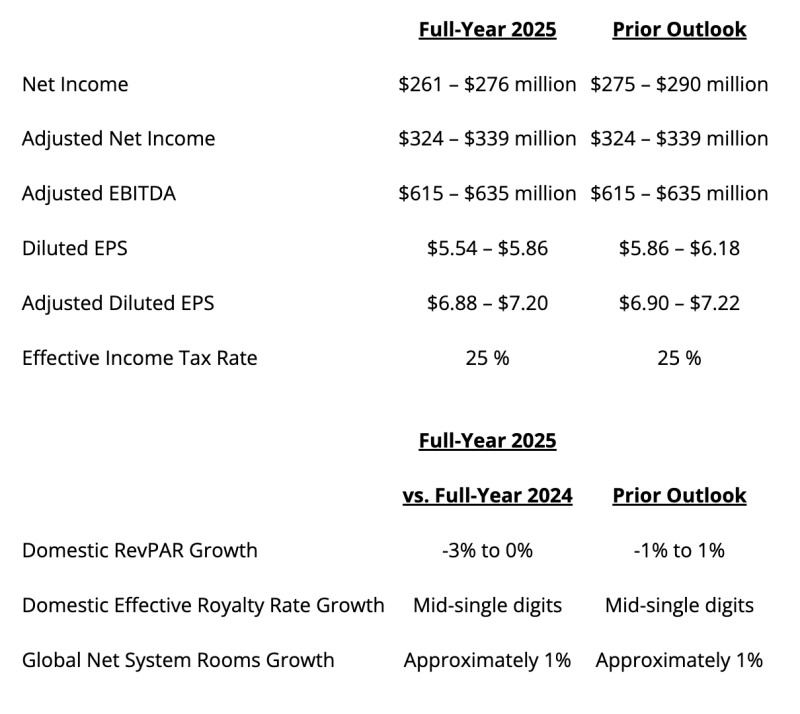

Adjusted Guidance

Reflecting what he described as an “uncertain macroeconomic backdrop” that is affecting domestic RevPAR performance across the lodging industry—“particularly the midscale and economy segments”—Oaksmith said that Choice was adjusting its domestic RevPAR growth expectations to -3 percent to flat for the year. “The midpoint of this range assumes that the current trends we are observing will continue for the remainder of the year,” he said.